This webinar examines the significant changes in sales tax compliance following the Wayfair decision and what they mean for businesses operating across state lines. You’ll learn how economic nexus laws have increased complexity, what tools and processes can help manage compliance, and strategies to reduce risk. The session provides practical guidance for adapting to evolving tax regulations and ensuring your organization remains compliant while minimizing administrative burden.

Navigating Post-Wayfair Sales Tax Challenges

Discover Related Posts:

Stay connected with our Dynamics experts.

Sign up for updates, insights, and personalized support from Western Computer.

Western Computer

Western Computer is a Microsoft Cloud Solutions Provider (CSP) specializing in Dynamics 365 and Power Platform solutions, services, and support.

Unlock the Future of Smarter Selling

Book a consultation with a Dynamics 365 Sales expert to discover how AI and human connection can work hand-in-hand.

Featured Posts

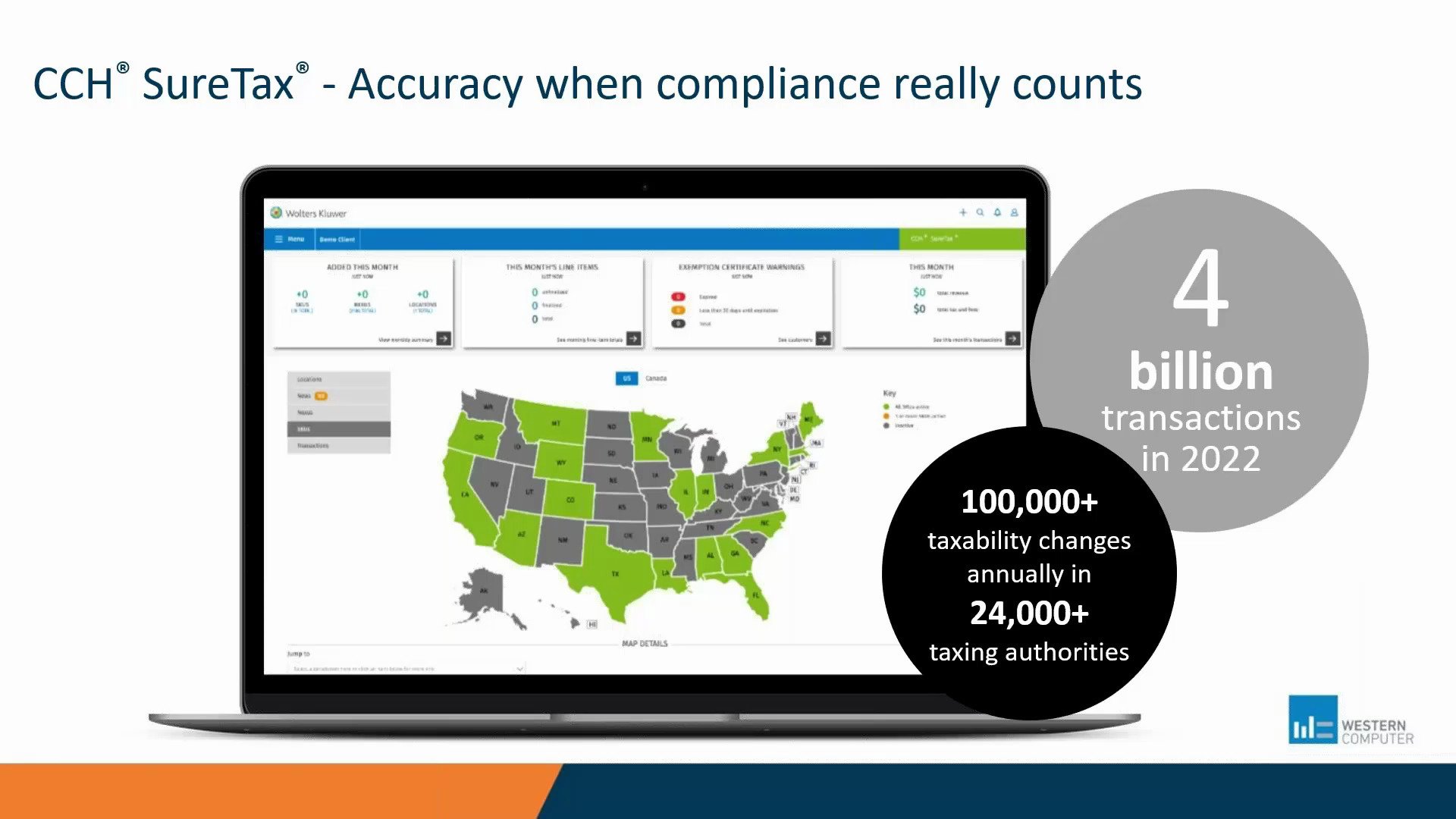

Reduce Audit Risk with CCH SureTax for Sales and Use Tax

Would you like to mitigate your Sales and Use Tax audit risk? What are your tax obligations? In today’s constantly....

Navigating Sales and Use Tax in a Post-Wayfair World

Sales and use tax compliance has become more complex since the Wayfair decision. This webinar shares strategies for....

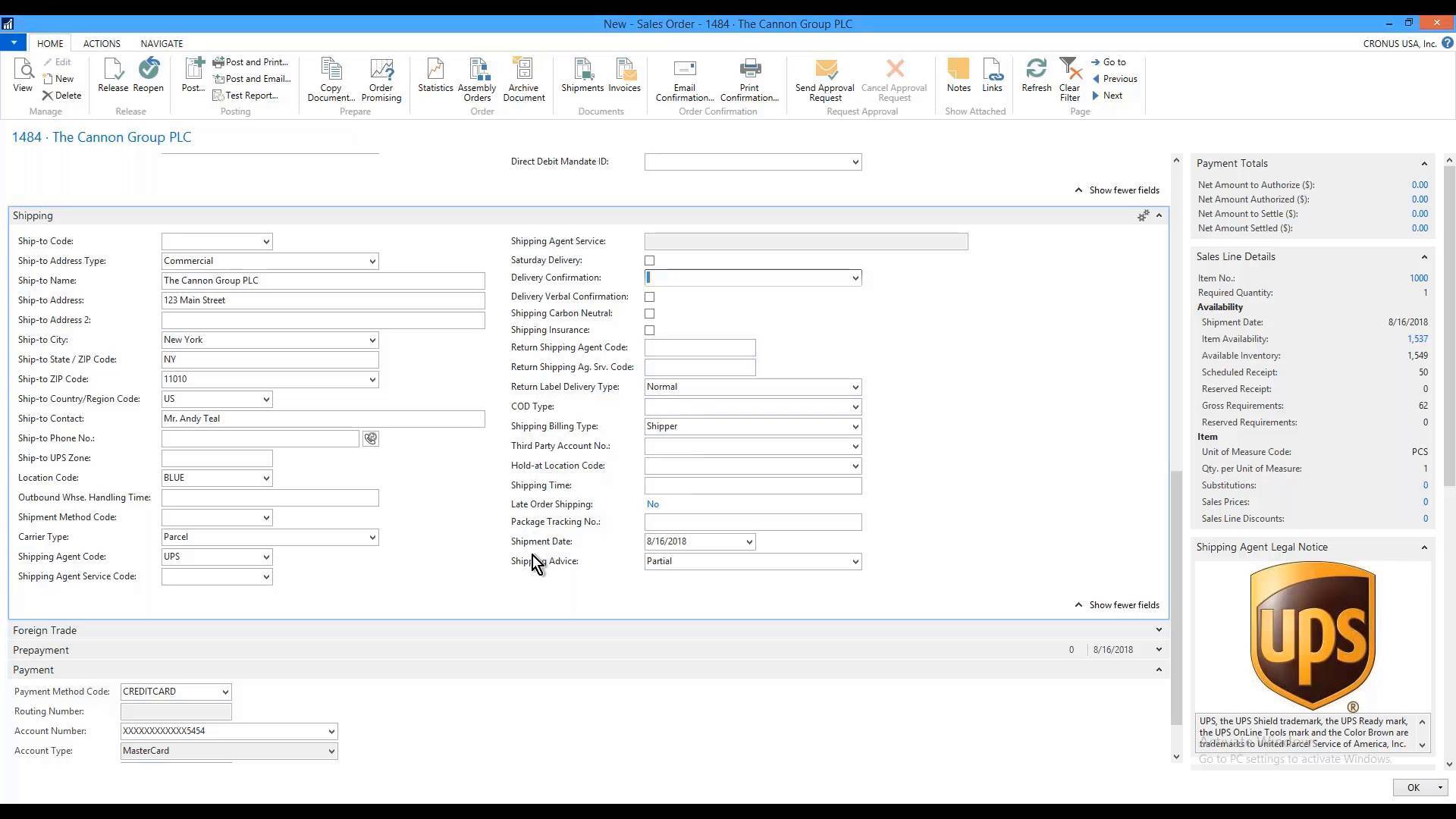

Secure Payments Simplified in Dynamics NAV with ChargeLogic

This webinar demonstrates how ChargeLogic simplifies secure payment processing within Microsoft Dynamics NAV. You’ll....